by David Berger

One often hears that the laws of supply and demand do not apply to housing markets. I may be biased--I am an economist by trade--but I believe that nothing could be farther from the truth.

What is the supply and demand framework?

At its core, it is way of understanding how buyers and sellers interact in a market. If the price of a good is high, people are willing to supply more of that good (if they can), while buyers demand less of it. We can use the framework to understand how prices will adjust when demand and supply change. If more people want to purchase something (demand increases), or it if becomes more expensive to make more of something (supply decreases), we would expect prices to rise. This immediately gives us two possible reasons why housing might be expensive: many people want to purchase it (high demand) or there are not enough homes for sale (low supply).

Do you have any data to back this up?

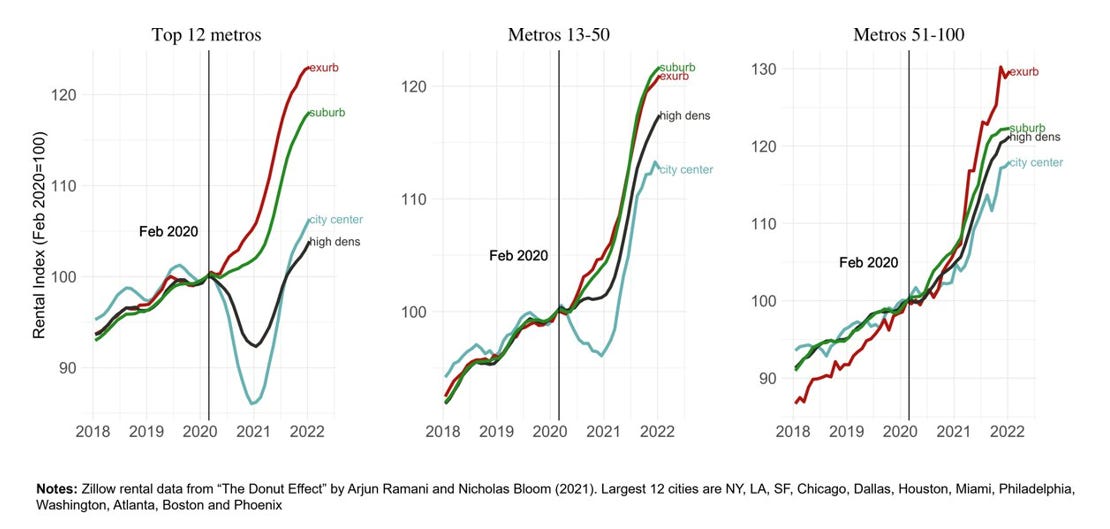

Yes. Consider housing markets around the onset of Covid-19 in early 2020. As people locked down and many jobs went remote, people left dense downtowns (like NYC, SF, Chicago) for more space in the suburbs and smaller towns. A recent paper by Stanford Economist Nick Bloom and his co-author Arjun Ramani explored the implications of these events for rents and house prices. The supply and demand framework makes multiple predictions all of which are born out in the data. It suggests that rents should have fallen in the most dense city centers where demand fell the most (left panel), and risen the most in the suburbs and smaller metro areas where demand increased (all panels).

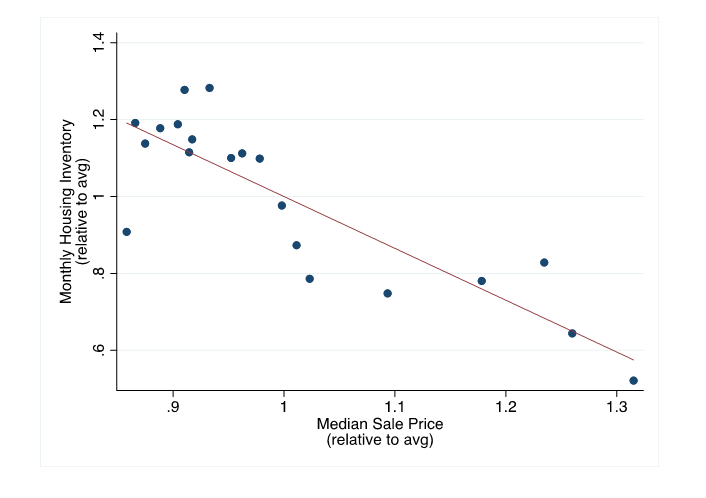

Closer to home, we can examine the relationship between supply and demand directly in the Durham housing market. The figure below plots the relationship between the amount of housing inventory available in a given month, a key measure of housing supply, and median sale prices over the period 2018-2022. As is clear, when there is less supply (inventories are below average), houses sell for more than they would typically. Thus once again the supply and the demand story is born out in the data.

Why are housing prices rising so quickly in the Triangle?

Now that we can agree that the laws of supply and demand apply to housing markets, we can use the framework to understand why house prices are growing so rapidly. First, there are a lot of demand side pressures: the Triangle is one of the fastest growing areas in the country because there are plentiful jobs and nice weather. Second, until recently, mortgage rates were low, allowing people to afford more expensive houses. Finally, we did not build enough homes so supply was limited. All of these factors combined to make prices increase.

Can building actually help? It seems that more building just leads to higher house prices.

Yes, building can really help. The best evidence comes from Tokyo.[1] Despite Tokyo being a world class city, on par with New York City and London, you might be surprised to learn that since 2000, house prices in Tokyo have been roughly constant, while they have more than doubled in NYC and SF. Tokyo is able to maintain affordability by removing local restrictions that restrict new building (e.g. local planning commissions, rent control, height restrictions, all of which are pervasive in America), ensuring that enough new housing is built to satisfy demand. By some estimates the Japanese build at twice the rate at which we do in the U.S.! The net result is that prices in Tokyo remain affordable, while prices skyrocket in the U.S.

The cautionary of Chapel Hill reenforces dangers of not building enough. In the 1990s, NIMBY leaning neighbors got control of the Chapel Hill city council and put in place zoning restrictions that made it much more difficult and costly to build new housing. Now the average price of single family home is now over $650K.

Conclusion

How can we make housing more affordable in the Triangle? As this article has made clear, there are two ways to lower prices: we can increase supply by removing local zoning restrictions, making new construction cheaper and by building more housing. Or, we can lower demand to live in the Triangle by somehow convincing people to not want to live here. Hopefully, the choice is clear!

[1] ttps://www.wsj.com/articles/what-housing-crisis-in-japan-home-prices-stay-flat-11554210002 for full details.