Investors: the Real Housing Villain?

BIGGER PICTURE | Big companies don't own many houses in the Triangle, and they're far outnumbered by the houses we haven't built

Sierra Stoney at the Federal Reserve Bank's Richmond branch recently released research into investor activity in Southeastern states' housing markets, using property tax records to count any investor who owned five or more houses. Some findings that may be surprising to you, given the ample media attention this topic has received recently:

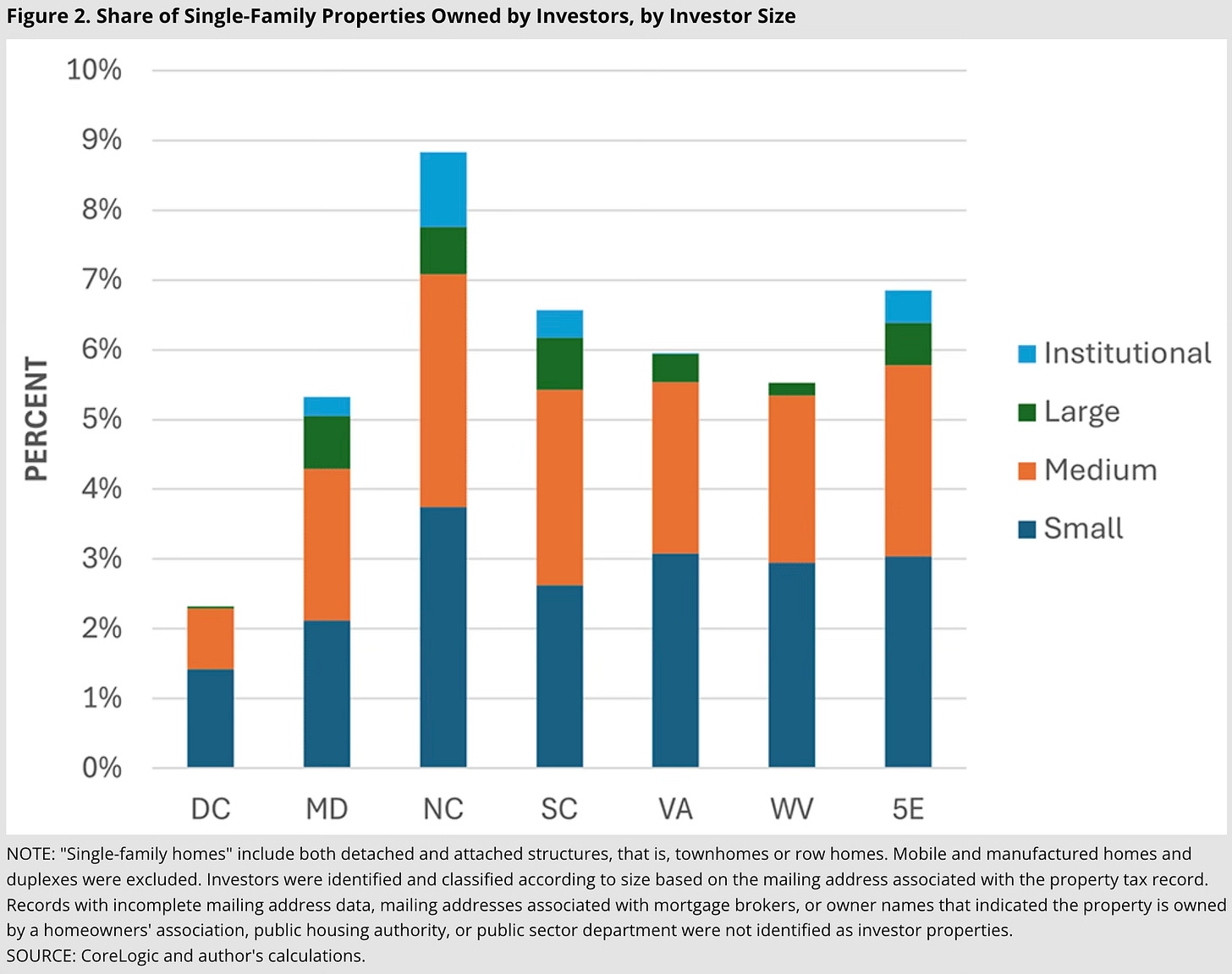

Overall, investors own less than 7% of single-family houses (including townhouses) in the Fed's six-state region. That's fewer than one in 14 houses.

North Carolina leads the Fed's region, with investors owning about 9% of single-family houses. The highest shares of investor-owned houses are in Coastal Plain counties of the state; in the Triangle, Durham County has a higher share of investor-owned houses than either Wake or Orange counties, which have investor shares well below the state average.

Institutional and large investors own very small shares of the housing stock. In North Carolina, just over one percent of all single-family houses (and 12% of investor-owned houses) are owned by investors with more than 1,000 houses, including publicly traded Real Estate Investment Trusts (e.g., Invitation Homes) and private equity investors (e.g., Blackstone).